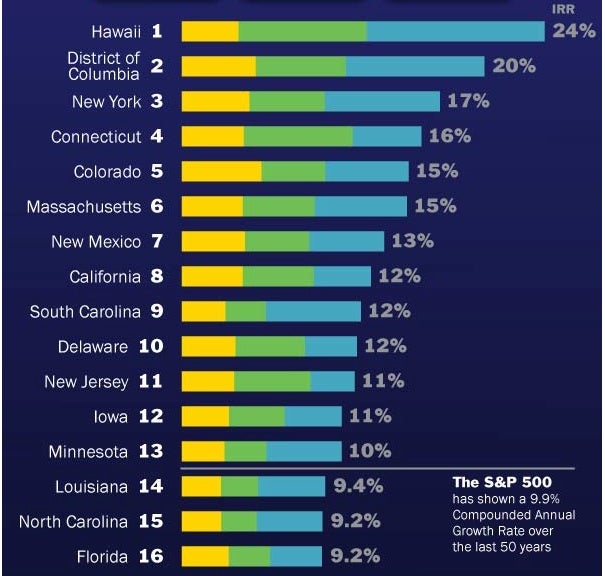

Thirteen might not be a lucky number, but it seems like a better number when you consider that in 13 states—over a quarter of all states, including the most populous ones like California and New York—solar offers a better return on investment than investing in the S&P 500. That’s just another way to look at why solar is a better investment today than many other investments people can make.

That’s according to the latest Geostellar Quarterly Index, which looked at the profitability of investing in rooftop solar across the U.S. The report found that the internal return on investment over the anticipated 25-year lifespan of solar panels was highest in Hawaii (24 percent) and that the majority of top states for internal returns on investing in solar were primarily on the East coast.

Among the top 10 states only California (eighth with a 12 percent return), Colorado (fifth with a 15 percent return), New Mexico (seventh with a 13 percent return) and aforementioned Hawaii weren’t on the East coast. “Surprisingly, California, Arizona and New Jersey, 2012’s top three solar states by installed capacity, are not among the top five states in the index,” Goestellar said. “Tax credits and other incentives in New York and Connecticut have helped propel those states toward the top of the Geostellar Solar Index.”

“In much of the country, the Geostellar Solar Index shows that homeowners can actually generate more wealth with solar panels than stocks, bonds, CDs or other investments,” asserted Geostellar Founder and CEO David Levine. “The index’s findings show residential solar power is not only viable, it’s a wise investment,” he added.

“Residents of the top states in the index can see their investment would be completely paid back in four to six years, and then receive free energy worth another five times’ that amount,” said Mark Wirt, Geostellar’s senior analyst. Wirt said there are now more options for third-party financing and zero-money down offers because solar energy costs continue to come in at lower rates than conventional generation over the life of solar panels. “We’re watching closely the movement of the national, regional and local solar markets, including the latest information on costs, incentives and rates in our analysis of individual homes, which also accounts for roof shading, slope and orientation,” he added.

The index includes analysis of actual solar rooftops the amount of insolation (solar radiation) throughout the year, as well as county-by-county tax credits, rebates, renewable energy credits and other incentives, local utility rates, installed costs of solar, and other variables, the company said. The report found that while the top 13 states offered better return rates than the S&P 500, more than half (33) offered better returns on investment than 30-year U.S. Treasury Bonds, which carry a 3.7 percent return.

“We’ve never seen a database like the one that Geostellar has constructed,” said Raquel Fagan, vice president of Earth911 Media, which will help publicize the index. The report also observes the importance that local, state and federal incentives and tax credits play in determining how much of a return a solar investment can make.